Everybody is talking about AI-related stocks. As if you don’t have an opinion on Nvidia, you look like you just came out of a cave.

The current AI Saga reminds me of the late Charlie Munger on people trading crypto currency: “It’s like somebody else is trading turds and you decide, I can’t be left out!”

Obviously, AI is real. It is not turd.

The AI applications have always been here – Generative AI just made it more accessible to the public.

But the frenzy is real. The word “AI” appeared within earning calls in 36% of S&P 500 companies.

From the Transcript.

I don’t have special insight on how the AI trends can be a thesis for companies in semiconductors, software, data centers, hardware tech, etc. I am totally fine missing out on stocks like Super Micro Computer. I don’t need to pounce on every trend; all I am looking for are 1-2 good ideas per year.

Upon talking to a friend and doing some shallow research, I came to a general insight: AI is as good as the data it uses; businesses need to modernize their infrastructures and software for gathering relevant data to embrace these AI trends. Therefore, they hire IT consultants to do the work to improve their digital assets.

That’s where IT consultants come in. That’s the AI angle worth exploring – the shovels behind the gold rush.

However, there is a much broader IT Service market here. I segmented it into 3 stages: 1) advice, 2) implementation, and 3) operations.

Advisory is like telling you to buy a car, implementation is buying that car and setting it up, operation is driving the car for you and taking care of it.

A digital transformation project starts with the advisory. Consultants, like doctors, diagnose diseases in a firm and propose solutions to address them. Many IT projects are done for reasons such as increasing user engagement, improving employee satisfaction, or optimizing workflow. But for major transformation projects, the symptoms are often signs of larger strategic issues – obsolete product-market fit, lack of critical resources, outdated business goals. That is where you combine IT consulting with management consulting to address the root cause. The price of the advisory piece could range anywhere from a few $100Ks to multi-million dollars. Most advisory projects take a few months to complete, upon which they are transitioned into implementation projects. The key winning factors are brand reputation and customer relationships.

Next is implementation. The implementation consultant works with a vendor partner to carry out the plan from advisory. If management consultants are architects, implementation consultants are general contractors. The bulk of the work is known as System Integration. It is done for adopting new applications (software development) or new infrastructure (IT Systems and processes). SAP implementation is one example, where a System Integrator creates new designs, moves old data into the new one, and sets up the processes around it. Simple implementation projects usually take a few months, but major tech transformation projects could last up to years. Implementation projects are often more expensive than advisory ones, but they share similar success factors - reputation.

Last is operations. Many companies offshore their IT works to Indian workers to lower costs. The work can be Business Process Outsourcing (i.e. operating the IT functions) or Managed Services (i.e. maintaining the IT infrastructure). These projects all run on multi-year contracts. Depending on the nature of the service, some BPO-ers have switching costs while others go into price-competition.

The IT Service industry is a trillion-dollar industry. Capgemini estimated in 2020 that the consulting market itself is $190B, implementation market at $250B, and BPO is $160B, and Managed Service is $420B. Here I compare some operating and financial metrics of IT consulting companies:

Key metrics of some major consulting firms, self-compiled. Note* Market share is relative, based on sum of peer group (27 companies), not TAM. The full list is in the footnote.

I gathered from Gartner on the relative exposure on each segment for major IT Service Providers.

From Gartner’s IT Service Market View 2022.

Accenture stands out immediately as it has a substantial market presence in all 3 stages.

We don’t need to bet on which tech vendor is taking market share, we just bet that Accenture will benefit whoever wins. Accenture was founded in the 1950s. It was spun off from the accounting firm Aurther Andersen in 1989 and listed publicly as Accenture in 2001. In the 2000s, it made a lot of money with large ERP system integrations like Oracle, Dynamics, and SAP (S4/HANA), on-prem implementations. Then came the decade of cloud migration in the 2010s. Microsoft Dynamics became Dynamics 365. Accenture helped move systems off-prem by implementing cloud solutions from the same few vendors (SAP, Salesforce, etc) + newcomers like AWS. In 2020s, I see that AI is the theme of this decade.

The moat is impregnable for Accenture: Advisory & Implementation are protected with brand reputation, while Managed Services & BPO are protected with switching costs. Brand and reputation matter in IT consulting because of its high “intangibility” nature as well as customers having a large capital and time commitment. By the time a project gets passed down to operations, Accenture then protects itself from losing to low-cost provider with customer-specific operational know-how and safekeeping mission-critical data.

Do note that Accenture also classifies sales in the implementation process as “Managed Services” because they are multi-year contracts. It gets a bit confusing in the annual report.

The bulk of the profit pool comes from implementation, followed by consulting and operation. Implementation has larger revenue share and better margins. Consulting has a small revenue share; Nonetheless, consulting is crucial for leading to the implementation part. As for the operation business, much of it has been commoditized; margins are thinner.

For example, if we provide consulting projects for 10 clients at $10m each and the follow-up implementation projects for the same 10 clients at $50m each. Despite having the same number of 10 consulting and 10 implementation projects, the revenue share is ~15%/85% between them. If we put a 10% margin on consulting and 20% margin on implementation, the profit share becomes ~10/90% across consulting/implementation. The numbers are hypothetical, I don’t have precise data.

That’s why being a consultant alone is not sufficient. While MBBs (McKinsey, Bain, and BCG) give fancy presentations at the end of their projects, Accenture follows up with implementations and operations.

I collected data showing the historical sales performance of Big 4 vs MBBs vs Accenture. It shows that the Big 4 consulting firms grew the fastest in the last 10 years. The Big 4 refers to Deloitte, PwC, EY, and KPMG.

Revenue of Accenture vs Big 4 (Consulting), vs MBBs, numbers in $M USD.

Nonetheless, I see that Accenture has a better model compared to the Big 4 and MBBs.

First, there is the regulatory aspect that hinders the Big 4 – there is built-in conflict of interest from selling consulting services to the same clients you are auditing to. It’s hard to be an independent auditing firm when your other arm is benefiting from the same client. There will be more stringent regulatory moves on this issue going forward. But recent EY news showed that splitting up the units is not easy. Their sales mix between consulting / audit & tax is ~45/55%.

Second, the culture in Accenture promotes more cross-function and cross-border collaborations. Big 4 and MBBs operate mostly on “partnership” mechanism while Accenture is more “corporate”-like. The people and firm cultures are different. The partnership structure revolves around individual partner P&L and unit KPIs, creating hurdles for cross-functions and cross-borders projects.

The key here is that Accenture’s clients have complex projects that require global scale and scope.

Accenture has set up its complex organizational structure accordingly. Calling it a matrix would be understating. We can split the firm using 5 service groups, 5 sector groups, 3 geographic regions, numerous client service groups or business functions.

The sheer size and scale are needed for Accenture to beat the competition. While Accenture has 700K+ workforce globally, McKinsey has ~45K consultants, PwC has 105K. Accenture has 4x the size in sales compared to McKinsey. I won’t bore you with the detailed comparison of every firm, you can refer to them in the footnotes.

Accenture has a reputation for providing cross-functional and cross-industry knowledge in different parts of the world, by cross-pollination of global resource pools. If Accenture has done a successful project for Barclays UK, it makes sense for similar works to be rolled out Barclays US, by Accenture again. That’s why the biggest asset is its tie with >200 “Diamond Clients” with over $100m in sales, having over 10 years of established relationship with 100 of them.

Major transformation takes years to implement across different regions, the mistake of corporations choosing the wrong partner is costly. The largest firms hire Accenture for peace of mind – previous instances of successful IT transformation help secure the win for the next project. When Singtel wants a 4G implementation in Singapore, Accenture has already done one with AT&T in America. The sales pitch is convincing because prior successful cases showed its capabilities. Accenture then take these capabilities to sell to Airtel in India using the same trick.

We looked from upstream (consulting) firms down, what about looking from downstream (implementation + operations) players up?

Accenture is the largest player with $64B in sales and is growing at HSD. Next player Tata Consulting has half the sales as an implementer moving itself upstream towards consulting; they are still a tier below in consulting. Capgemini’s sales are a bit over 1/3 of Accenture’s; it fights on the Europe front (~60% of sales) and primarily an implementer (consulting is only 9% of sales).

For the Accenture Operation segment that accounts for 15% of sales, the moat is not as strong. BPOs have been commoditized by Indian players. For traditional IT infrastructure support, corporations may insource it and there is competition from cloud providers. The strategic rationale of the operation segment is to keep the relationship going in hopes of bringing new transformation projects in the future – the cycle rinse and repeats with each new digital trend.

Now we know that Accenture’s competitive positioning is superior, what about the AI trend?

Accenture is using the name of AI to sell the same idea of digital transformation, again.

In Q3 ’23 call, management said it is planning to invest $3B in AI; in the next quarter, CEO Julie explained that current Gen AI initiatives are merely sort of $1 million dollar-ish deals. The real share of profits, I realized, are the migrations of IT infrastructure, systems, software, and data analytics – all the bells and whistles that come along.

Accenture calls it “having the right digital core” to embrace AI. Accenture mentioned in its Q4 ’23 call only 40% of the workloads are in the cloud, only 1/3 of the clients have modernized their ERP platform, and less than 10% have mature data and AI Capabilities. The global digital transformation seems like an unfinished project even after all these years.

I read this excellent insight from a Morningstar analysis:

Accenture has stressed the increasing portion of its business as "the new."… In our opinion, however, there is always something new in the realm of enterprise technology to keep Accenture relevant and engaged with its most important customers.

Well, that is the beauty of the business. Be it AI or whatnot, as long as there are new tech trends coming out every now and then. Its business model never becomes obsolete.

Accenture renamed the old Accenture Interactive into Accenture Song, and a new department with $18B sales is born. With acquisitions such as Droga5, Song is the new digital ads agency competing with the likes of WPP and Omnicom. But this $18B is also jumbled up with many of its other service groups in consulting, and operations. Accenture’s differentiating factor is having a more integrated approach, bringing in its own tech capabilities on top of giving ideas.

There is some double counting to make the numbers look bigger than they need to be. Inside the Accenture operations, many old projects are simply “re-tagged” with the label of AI and suddenly they joined this new class of AI trend. Doing so creates the attention it needs internally, and to get more customers onboard new trends – Accenture is leading such trends.

That’s pretty much about AI. Talking about how each consultant approach AI isn’t important. I won’t dwell on this topic further.

Let’s run through some numbers.

Accenture Sales Breakdown, figures from annual reports.

Accenture grew its top line for the past 15 years at around 8-9% on average. The currency impact causes each year’s growth to be 2-4% higher or lower. Over the long run, the effects cancel out with geographic diversity (NA is ~1/2 of sales).

In recent years, the Technology segment outgrew Strategy & Consulting and Operations, from 47% to 64% of sales. This is to be expected given implementation projects have larger price tags. I already explained that.

The sector exposure moved with industry spending trends. There has been some weakness in the communication industry in recent quarters that led to 6% lower sales in FY23 and weak NA sales growth. These things happen; but in the long term, each industry growth balances out each other – Accenture is diversified enough to not be overly exposed to one. You can see the detailed breakdown in the footnotes.

Accenture’s OP margins fluctuated around a narrow 13-15% over the years. There is no reason to believe that there’s anything different going forward.

Better to look at free cash flow, where it grew from $2.5/share to $11/share over 12 years. Accenture is a cash rich business – Cash conversion has been >100% in historical average. But high ROIC means nothing if the cash can’t be reinvested into new growth. This is a people’s business, where there’s not much physical assets to invest in. Accenture spends the cash to acquire smaller firms each year and rolls them into its business system. Once we consider these cash acquisitions, FCF / share has been much smaller in recent years (FCF margins post-acquisition is only 7% on average compared to 10% net margin). But as you will see from the next company, taking a toll on margin is a much better option than meager growth.

Accenture’s Capex vs Acquisitions, from CapIQ data.

Accenture’s FCF per share, my own calculations from CapIQ data.

Next company is Cognizant Technologies.

Cognizant started as an in-house tech center for Dun & Bradstreet, got spun off in’96 and went public in ’98. Its business model is System integration + Operations. Cognizant’s job is to take client’s proposals made by the likes of McKinsey or Deloitte’s, set up the systems, write the Apps, and run it for clients. Recall the 3 steps I mentioned earlier: Advice -> Implementation -> Operations. Cognizant has ~60% of its sales in the middle one, and 40% in the last one. It’s the general contractor.

The company had a fantastic period of growth between 2000 and 2016, owing to 2 key factors: 1) good management culture and 2) good industry backdrop. But after 2016, the company was hindered by poor industry trends and management change. Growth has stagnated and it is now faced with a lot of uncertainties.

In the early 2000s, Cognizant was run with a start-up culture, where account managers were empowered to take decisions. The model was hinged on rapidly growing sales while keeping modest margins. Former CEO Frank D'Souza did an excellent job in leading the firm. He ran the small company like a family and treats the employees well. Attrition rates were around 15%, below industry average. Happy employees provide quality services.

The second factor plays a bigger role. Cognizant caught the secular trend of banking and healthcare IT outsourcing (~60% of sales). Major firms like J.P Morgan were taking their IT headcounts out by transferring many IT costs out to India. Cognizant used the “land and expand” strategy to cross sell more implementation services and built up its operation business.

Cognizant offered decent quality with cheaper prices by having onshore/offshore teams working simultaneously. Among Cognizant’s 350K workforce, 250K of them work in India. This “2-in-one-box” model of having 1 team onshore working with 1 team offshore, was at the time, unique. The fact that someone stationing onsite in America allowed Cognizant to differentiate itself from Indian consulting firms which were seen as poorer service. The quality matters because ~80% of Cognizant sales are for North American firms. The results were fantastic – Cognizant averaged over 30% in sales growth, with ’09 being the lowest growth with merely 16%.

Cognizant’s margins were higher than Accenture due to the business mix. Cognizant’s 16-18% margin is lower than Indian players Tata Consulting Services’ 20-23% and Infosys’ 30% margin. These two larger firms had cost advantages because they were better at hiring and training Indian workers. But Infosys’s margin had since dropped down to 20-23% as well. This market is already heavily commoditized.

The growth was good, but the weakness of the model showed itself after ’16.

The outsourcing trend in banking reversed into insourcing, while healthcare players are consolidating to cut costs. Cognizant’s industry exposure was over reliant on banking and healthcare. In hindsight, Cognizant should have diversified its customer exposure earlier, but who can blame them if they were growing 30%+ sticking to a winning formula?

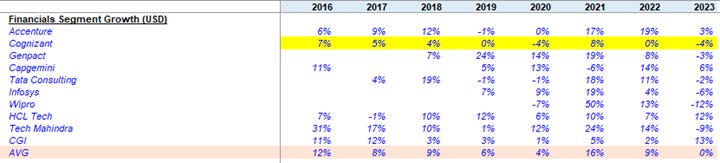

But industry weakness is no excess for poor competition positioning. Cognizant did not have a strong advisory business unlike Accenture and was eventually outbid by lower-cost competitors or customer’s in-house tech operation teams. I gathered some peers’ numbers on each “banking & financial” segment growth – the data showed that Cognizant problem is more isolated.

Cognizant’s financial segment growth compared to peer’s financial segment, self-calculation from official data.

With the growth engine stopped, investors questioned its weaker margins and de-rated the stock from 21x to 14x. Elliot Management, headed by Activism investor Paul Singer, took a stake in Cognizant in 2016 and initiated a proxy fight to push management to fix its core and focus on margins.

This is the issue with consulting business. If growth is not there, run the hell away. The high ROIC means nothing without reinvestment opportunities. There is not much physical asset to begin with anyway.

Management responded – on margins not growth! Michael Patsalos-fox lead the transition to form a new board looking for a CEO replacement to bring in some new ideas. Perhaps it is time for someone that is more structured to move the company into the next phase – maturity. Brian Humphires was hired in 2019 to be the CEO.

Brian had no prior experience in consulting. There was a massive exodus of top and bottom employees. The new board formed had a different vision. Brian thought Cognizant had grown too cumbersome and complex, so he went through a workforce overhaul and simply the internal structure. Margins and capital returns became financial goals for Cognizant and deals were turned down due to poor profitability requirements. The DNA of the firm has changed into a cut-throat culture. Cognizant’s reputation was tarnished among new tech grads and its worker attrition rate spiked up to nearly 30%.

This heavily affected delivery quality. Many implementations and operations span across multiple years. Letting go of a manager who knows how to run and manage processes is quite a hassle. Ultimately, consulting is a people business, losing confidence in the people you hire is the worst-case scenario. Reputation among employees and customers is the utmost important resource for a professional service firm.

The promise of improving OP margins did not materialize either, partly due to the high attrition rates adding to costs training new employees. Margin did not go back to its previous level of 16-18%. To be fair, growth was a bigger issue since FCF margins were low in the earlier years anyway. OCF was offset with capex spent to build delivery centers in India and Europe.

Cognizant’s OP margins and FCF margins, my own calculations using official numbers.

As much as Cognizant looked to become the tier-1 IT consulting firm like Accenture, it had no real moat. The onshoring/offshoring strategy is also done successfully by Accenture and peers, and 2) Cognizant’s core business was outcompeted by Tata Consulting and Infosys where it had better cost structure due to superior in-house training.

Cognizant’s sales growth and segment exposure, from official numbers.

Capital allocation of the new management did not offset the back luck of the weak industry backdrop. The ~$4B+ spent on acquisitions for the last 6 years did not help financial services and healthcare sales to grow. Top-line growth was below 5% each year except for ‘21. Since ’19, $8B of buybacks were spent instead to boost EPS growth. The strategic rationale for the acquisition was that new management tried to integrate different services horizontally. Hindsight is 2020 – management could have done more on existing sales account than going after new areas.

Cognizant’s FCF per share and valuation, my own calculations from CapIQ data.

Brain stepped down in 2023 and Ravi Kumar came in as the new CEO. He had a solid background as an ex-Infosys NA president for 9 years. Ravi came in to fix the workforce. He understands the importance of having good people and keeping them around. The attrition rate dropped to 14% recently, but sales and margins have not improved yet – not even with the AI boost. I have no framework for assessing turnaround by a new CEO on a company where I see no moat in. So, I am going to end it here. If you do know how to assess this situation, do leave a comment!

The last company is Reply Spa.

Reply is a small $2B company founded by Mario Rizzante in ’96 and went public in ’00. At its core, Reply is mostly a system integrator, which sits on the implementation part of the market I explained earlier. It works with different vendor partners and provides specialized services to implement unique IT solutions using their offerings. What makes it interesting is that its stocks outperformed all the other larger IT consulting firms with 21% compounded returns over the last 10 years.

Reply’s Total Return Compared with peers, from Bloomberg.

Reply does not have the scale that larger firms like Accenture and Capgemini enjoy, so it must play a different game – a game of speed and innovation.

Accenture has a Global Management Committee (GMC), a group of 30-or-so people that oversees the major direction of the firm. It’s like this huge Titanic-size battleship out there where each turn takes a careful decision. The captain of this ship is CEO Julie Sweet. She directs the ship by going after the more mature IT trends for the largest clients.

Reply is different. It was set up in a decentralized structure. Each unit specializes in one area, and it has freedom in hiring consultants and choosing projects. Each has a separate balance sheet and P&L and is self-accountable for performance. It is an amalgamation of ~200 subsidiaries running separately. While industry giants charge forward like battleships, Reply is like a fleet of agile destroyers, where they play at the forefront of the most innovative tech implementations. The decentralized structure allows for faster decision-making, so each unit responds well to new market trends.

Looking at Reply is like walking into a supermarket of consulting services. The following are some examples:

Cluster Reply (Microsoft Azure)

Storm Reply (Amazon AWS)

Arlanis Reply (Salesforce)

Click Reply (Supply chain)

Discovery Reply (Digital experience)

Gaia Reply (Mobile applications)

Sprint Reply (Process automation)

Target Reply (Data Analytics)

Autonomous Reply (Autonomous devices)

Roboverse Reply (Robotics)

The role of the corporate parent is to manage the sub-units appropriately. That is where the Rizzante family steps in to do portfolio management. Let’s say a unit is suffering in sales, and the services are seen as either uncompetitive or outdated. Management shuts it down and sends the employees into another unit in need of brainpower. If a unit has bet on the right trend and is experiencing rapid growth, management splits up the team and creates a new unit for better product focus.

This bottom-up method in letting the results guide what to offer is a stark contrast to Accenture’s top-down approach in betting safe & major digital trends. This is how Reply has been able to take shares in its Italian market over its larger competitors, by offering the most innovative tech implementation services in the market. CEO Tatiana and the rest of the family are very involved in the company. They talk to the network partners regularly and keep the senior managers within the firm.

Essentially, investing in Reply = investing in the Rizzante family. The implicit premise is trusting their judgment in capital allocation.

Reply’s growth strategy revolves around 2 parts: 1) continuously buying other companies, 2) take advantage of the network effect by making sub-unit collaborate.

On the first point, management is always on the lookout for new acquisitions, be it local or foreign markets. Looking at the cash flow statement, there is no physical Capex spending, but mostly cash acquisition and cash spent for intangibles. CTO Filippo Rizzante, brother of Tatiana, oversees acquisitions of new technologies.

Reply buys out the smaller units and integrates them into the network. Upon acquisition, Reply finds out the IT vendor (e.g. AWS) used by the customer of an acquired firm, calls the local CEO of that vendor to go to this customer and sell Reply's implementation package instead. Reply looks for companies that have reached a certain age and are interested in being sold off. In recent years, efforts have been made on foreign expansions.

After doing it so many times, the integration process is made seamless. The acquired company ABC gets renamed as Reply ABC, and its back-end admin and tax systems are ported into the network. The business will run as normal. In most cases, the key person joins Reply as network partner since they work for passion.

As for collaboration, the idea is to make subsidiaries work with one another for bigger projects, creating larger scales for bigger projects. For example, Reply Logistics works with Retail Reply to come up with a Warehouse Management System. Sadly, it does not happen as often in reality. These are mostly done on an informal basis as there is no process in place. The incentive is also an issue. If you have so many separate P&Ls, it is hard for each reporting head not to be self-interested and turn it into internal competition.

To encourage co-opetition, Reply HQ sets intercompany charges for units working together. But some of them offer similar services. For example, Autonomous Reply and Roboverse both offer automation solutions involving robot use for supply chain. With such a decentralized structure, the lines aren’t really drawn clearly as to who-do-what, I suppose some cannibalization can’t be avoided.

From Intesa Sanpaolo Research Initiation Report.

Reply’s average sales growth of 13% for the last 15 years was mostly organic while being a serial acquirer. Management has done well in both finding deals and managing existing ones. Acquisitions were quickly assimilated into the current network.

Reply segments its business based on 3 regions. Region 1 is mostly Italy (Italy is ~half of sales) plus US, Brazil and Poland. Region 2 (20% of sales) is Germany + Switzerland. Region 3 is the rest of the world. While Region 1 is 14-17% OP margin, Region 2 is only 10-12% margin. The margin gap comes mostly from Italy alone, where Reply’s positioning has surpassed many local larger players in market share to be #3, catching up to Accenture. Overall, the model worked well to generate fantastic growth while improving margins.

Reply’s Growth and Segment Margin Difference, from official data.

From Societe Generale Initiation Report.

Since 2010, Reply’s FCF per share went up 7-for-1, beating Accenture’s 4x and Cognizant’s 6x. Not surprisingly, Reply had ~1/3 of cumulative FCFs went into acquisitions.

Yet, share price has come down 50% peak to trough since November 2021, twice as much as FTSE MIB’s 25% drawdown. During the same period, fundamentals did not deteriorate. Reply maintained low double-digit growth and decent OP and FCF margins. The main reason was multiple compression from over 40x to 15x.

Forward P/E Ratio of Reply Spa, from CapIQ.

As for the business, I have two issues that remain unsolved.

First is the uncertainty in future growth. The Italian market is getting saturated with sales expected to grow merely HSD, and the current model is hard to be replicated elsewhere. Without cheaper labor supply, Reply finds it hard to hire people of the same quality with the same costs in places like the US and the UK. In Italy, Reply could easily pay a competitive rate and still get the top-notch tech graduates from local universities. That is not the case in foreign land. The whole point of taking risks in small-cap stocks is to get better growth. If high-single-digit EPS growth is all there is, why not just hold S&P 500?

Second is management. Without the involvement of Rizzante to manage the business well, I foresee it to crumble very fast. Put simply, I have no faith that the system in place is proven to ensure things work without the founding family yet. This is the issue with small caps stocks – when track record is short, you can’t tell if it is due to luck or skill. Ultimately, what I am looking for is whether the company has a unique culture that stands the test of time. If I must bet on any one person, I give up. I don’t personally know the management well. There’s no edge in conducting some secondary research online on the Rizzante family and making some subpar analysis on it. I can’t call that shot.

That is all for the 3 companies in this post. As per usual, let me summarize each case:

Accenture provides the full range of advisory, implementation and operations unlike peers. Accenture’s moats are brand reputation, customer relationships and switching costs. It has the largest market share and it services >200 diamond customers ($100m+ sales) with a global scopes and scales. The corporate structure, unlike a partnership one, makes global collaborations more effective. Responding to major trends, Generative AI is used as a trojan horse for Accenture to sell more digital transformation projects. Accenture checks all the boxes for what makes a good business to own for long-term. I am ready to value its stocks.

Cognizant suffered in growth and margins in recent years. It was over-exposed on banking and healthcare clients in the past and its low-price + offshoring model is no longer competitive. The company has no real moat, and its employee quality has suffered in recent years. The current thesis, if any, would be the turnaround case under the leadership of Ravi Kumar. I have no edge in assessing turnaround cases like this, and so I am passing on this.

Reply is a serial acquirer with a unique decentralized model. It has over 200 highly autonomous sub-units that respond quickly to new market trends. Its moats are 1) intangible – brand reputation as the forefront of tech implementation and 2) network effect by making sub-units collaborating. I have no confidence as to whether the system has been institutionalized. Am I paying for the business itself or the current management? I would pass on valuing this company for this reason – if there are more facts surfaced, I may change my mind.

Accenture’s valuation is not cheap. It is selling at 27x forward P/E. A DCF with an 8% top-line growth, 15% margin, 90% FCF conversion, 10% discount rate, and 4% terminal growth gets me somewhere $270/share, which is below its $300 current price. Using a more pessimistic case, if I lower the revenue growth to 4%, with 3% dividend + buyback yield, no improvement in margins, terminal multiple of 25x, my IRR is ~7%. Not cheap enough to warrant an initial position.

Since margins are stable, EPS growth contribution is all about top-line growth and share buybacks. Share buyback makes no sense if attractive acquisitions present themselves that leads to better organic growth. Consultant stocks being so acquisitive, a large part of my own capital allocation is essentially outsourced to management. My point is that it all comes back to the essence of a professional service business – people’s reputation and quality.

Footnote:

Here are some consulting KPIs:

Win rate means the percentage of offer that a firm gets out of the bids it submits.

Market share is the share of industry sales.

Utilization rate measures how well the firm is making use of the consultants.

Attrition rate measures how fast consultants are quitting the firm and implies typical tenure.

Peer List Market Share

Service tangibility spectrum (Source)

MBB & Big 4 Sales Comparison

Accenture Sales breakdown by Industry